White-Collar Crime: A Costly Epidemic

What is white-collar crime? It’s a broad term encompassing a wide range of non-violent offenses committed for financial gain. Individuals or organizations can commit these crimes, which can have a devastating impact on businesses, individuals, and society as a whole.

For businesses, white-collar crime can cause financial losses, reputation damage, legal costs, and lost productivity. For individuals, white-collar crime can have a devastating financial and emotional impact. On a macro scale, the trend erodes public trust in institutions and stifles economic growth.

White-collar crime is often labeled a “victimless” crime. It is not. It’s a serious issue that poses a threat to businesses, individuals, and society as a whole.

Types of White-Collar Crime

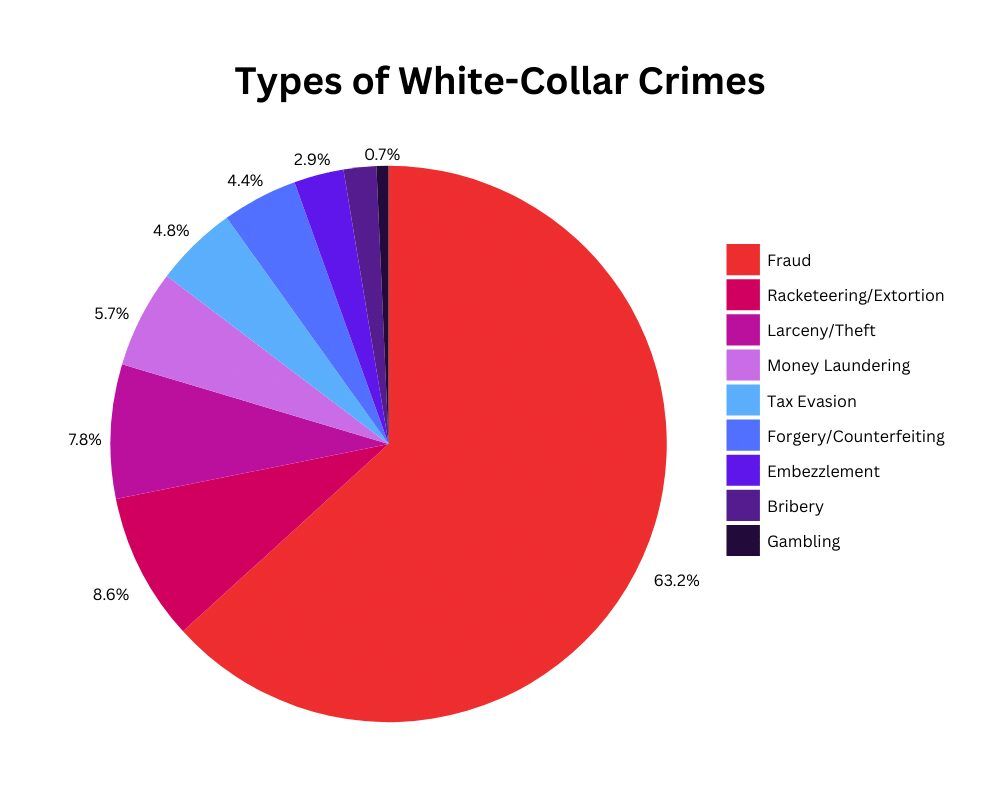

It’s an umbrella term that includes at least nine non-violent crimes. Of those, fraud—intentional deception to secure unfair or unlawful gain—is by far the most common. Racketeering/extortion—obtaining something of value through force or threats—is a distant second, and larceny/theft fills out the top three.

Data courtesy of Zippia.com

A few other common types include:

- Embezzlement: Embezzlement is the theft of money or property that another person or organization has entrusted to you. For example, an accountant who steals from their employer’s bank account is committing embezzlement.

- Fraud: Fraud is the intentional deception of another person or organization for personal gain. For example, a person who files a false insurance claim or sells counterfeit goods is committing fraud.

- Bribery: Bribery involves offering or receiving valuables in exchange for an official act or favor. For example, a government official who accepts money to approve a building permit is committing bribery.

- Money laundering: Money laundering is the process of making illegally gained proceeds (“dirty money”) appear legal (“clean”). For example, a drug dealer who invests their profits in a legitimate business is committing money laundering.

- Insider trading: Insider trading is buying or selling securities based on non-public information. For example, a corporate executive who buys stock in their company before announcing a merger is committing insider trading.

And the list goes on. The common thread is that white-collar criminals often exploit legal loopholes or use positions of power to enrich themselves at the expense of others.

A Few White-Collar Crime Statistics

White-collar crime is a serious problem that costs the global economy up to $1.7 trillion each year. White-collar crime costs the United States alone over $300 billion annually. The National White Collar Crime Center estimates that white-collar crime victims lose an average of $120,000 per crime.

Despite the high cost of white-collar crime, it is often underreported and difficult to prosecute. White-collar criminals are often highly skilled and difficult to catch. Additionally, investigating white-collar crimes can be complex and time-consuming.

Consider:

- White-collar crime affects over 35% of U.S. businesses.

- The average white-collar criminal is 41–60 years old and has a college degree.

- Over half of white-collar criminals are married and own homes.

- The average company can lose $9 or more per day per employee—up to 6% of their annual revenue—to white-collar crime.

- Identity theft is the fastest-growing type of white-collar crime.

- Only 3% of white-collar crimes are prosecuted, and the total number of persecutions dropped by 53.5% between 2011 and 2021.

- White-collar criminals receive shorter sentences than other types of criminals, and the average sentence is only 23 months.

No wonder it’s such a significant problem.

A White-Collar Crime for the Record Books

The largest (and most memorable) white-collar crime in U.S. history blew up in late 2008. It was a Ponzi scheme—a fraudulent business that attracts investors and pays profits to earlier investors with funds from more recent investors. Ponzi schemes got their name from Charles Ponzi, who ran an operation of this kind in the 1920s. However, this more recent Ponzi scheme was the brainchild of Bernie Madoff.

Over the course of several decades, Madoff defrauded his investors of somewhere between $12–65 billion. He pled guilty in 2009 and received a prison sentence of 150 years. Madoff died in 2021 at the age of 82.

This salient example illustrates how fraud and other white-collar crimes can have an enormous effect on many, many people.

The Impact of White-Collar Crime on Businesses

White-collar crime can be devastating to businesses of all sizes. It can lead to financial losses, damage to reputation, legal costs, regulatory scrutiny, lost productivity, and more.

Financial Losses

White-collar crime can cost businesses billions of dollars each year. The Association of Certified Fraud Examiners estimates that fraud costs businesses an average of 5% of their annual revenue. In other words, a business with $100 million in annual revenue could lose $5 million to fraud each year.

Damage to Reputation

When a business is embroiled in a financial scandal or fraud case, the public’s trust in the organization suffers. It then becomes difficult to attract both customers and investors. Warranted or not, the tarnished reputation can linger for years, resulting in diminished brand loyalty, market share, and a decline in stock prices.

Legal Costs

Investigating and defending against (or prosecuting) allegations of financial misconduct is a considerable drain on resources. Legal battles can be protracted and complex, further exacerbating the financial burden. Perhaps that’s why so many minor cases of white-collar crime go unreported.

Regulatory Scrutiny

Government agencies and industry watchdogs may intensify their oversight after a crime report, causing increased compliance costs and administrative burdens for businesses. These regulatory pressures can force companies to implement costly, time-consuming measures to prevent future offenses.

Lost Productivity

Beyond the direct financial impact, white-collar crime also affects workforce productivity. As employees become entangled in investigations or grapple with the aftermath of a crime, their focus shifts away from core tasks, affecting efficiency and the overall functioning of the organization.

Businesses can take steps to protect themselves from white-collar crime by implementing strong internal controls, training employees on fraud prevention, instituting a whistle-blowing policy, and conducting regular audits. However, even businesses with the strongest safeguards in place can still be victims of white-collar crime.

The Impact of White-Collar Crime on Individuals and Society

The far-reaching impact of white-collar crime extends well beyond the boardrooms and corporate offices, deeply affecting individuals and society at large.

Erosion of Trust

Whether the organization in question is a major corporation, a government agency, or a financial institution, instances of white-collar crime can shake the public’s faith in these entities. This breach of trust can be so profound that it tarnishes people’s perception of the very institutions that claim to provide security and stability. If you can’t trust a bank to protect your money, who can you trust?

Increased Inequality

Moreover, white-collar crime has the potential to exacerbate economic inequality. Often, it’s the most vulnerable segments of society who bear the brunt of these crimes. Ponzi schemes, financial fraud, and predatory lending practices can leave low-income individuals and families in dire straits, perpetuating a cycle of poverty and disparity.

Harm to Victims

The impact of white-collar crime is not limited to the financial realm alone, either. Victims—whether they’re employees of a fraudulent company or defrauded investors—can suffer devastating emotional losses as well. The toll of being deceived and betrayed by those in positions of authority can be profound, leading to stress, anxiety, and even long-lasting trauma.

Crime of any kind destabilizes our collective well-being and sense of peace.

Reduced Economic Growth

In a broader sense, white-collar crime can hinder economic growth. It discourages investment, as potential investors become wary of putting their money into institutions that may not have their best interests at heart. Innovation may also suffer as resources that could have been directed toward research and development are instead expended on addressing the fallout of financial misconduct.

A victimless crime? Hardly.

White-collar crime’s impact resonates throughout all levels of society. Addressing these issues requires not only legal action against offenders but also a concerted effort to promote transparency, accountability, and ethical practices in both the public and private sectors.

What You Can Do About White-Collar Crime

If you suspect that you may be the victim of a white-collar crime, report it to the authorities immediately. Law enforcement agencies have specialized units that investigate white-collar crime. They can help you recover your losses and bring the criminals to justice.

In addition to reporting white-collar crime to the authorities, there are a few things that businesses and individuals can do to protect themselves from becoming victims:

- Businesses should have strong internal controls in place to prevent fraud and embezzlement.

- Individuals should be careful about who they trust with their personal and financial information.

- Individuals should be aware of the latest scams and fraud schemes.

Data Science: A Possible Deterrent

Data science—with its powerful analytical tools and advanced algorithms—is increasingly becoming a potent weapon in the fight against white-collar crime. It offers an innovative approach to detecting financial misconduct by leveraging data in innovative ways.

By analyzing vast amounts of financial and transaction data, data science can unearth patterns and anomalies that might elude traditional detection methods. For example, it can identify irregularities in financial transactions, uncovering fraudulent activities in real time or during audits. Machine learning algorithms can sift through immense datasets to detect subtle signs of fraud or irregularities, which would be impractical—if not impossible—for humans to analyze manually.

Another useful crime prevention solution is predictive analytics. By creating predictive models based on historical data, businesses can forecast potential fraud risks and take proactive action.

Stay Safe(r) with Deep Sentinel

Deep Sentinel is your trusted partner in ensuring the safety and security of your business.

Our state-of-the-art surveillance and live camera monitoring solutions go beyond traditional security measures, not only protecting your business from physical crimes but also keeping a vigilant eye on your premises—and your employees—after hours. With advanced AI technology and a dedicated team of live guards, we offer office building security that can deter and prevent unauthorized access, theft, and vandalism.

Explore Deep Sentinel’s business security cameras for your commercial property. Wireless security cameras are perfect for smaller properties. If you need broader coverage and better data and power stability, a PoE security system is right for you.

With Deep Sentinel, your business is in safe hands.

Need a Solution that Prevents Crime?

Deep Sentinel is the only security technology that delivers the experience of a personal guard on every customer’s home and business. Visit deepsentinel.com/business or call 833-983-6006